Commodity Resin Prices Dropping

A reversal of several industry factors is likely to drive prices down this quarter.

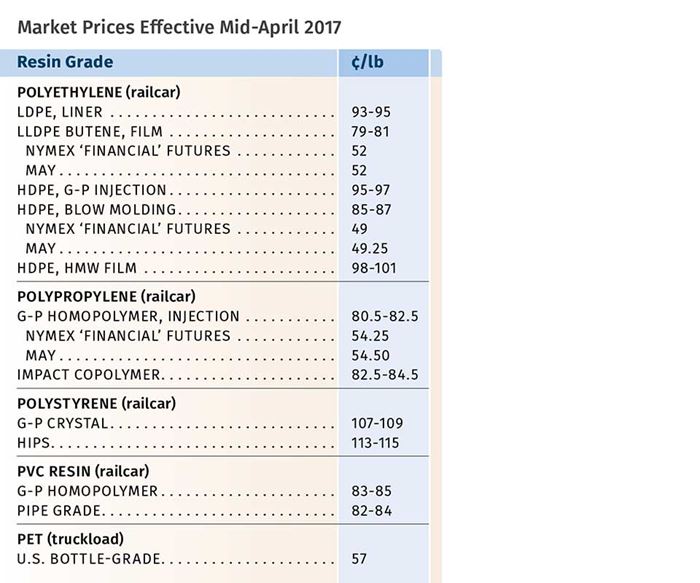

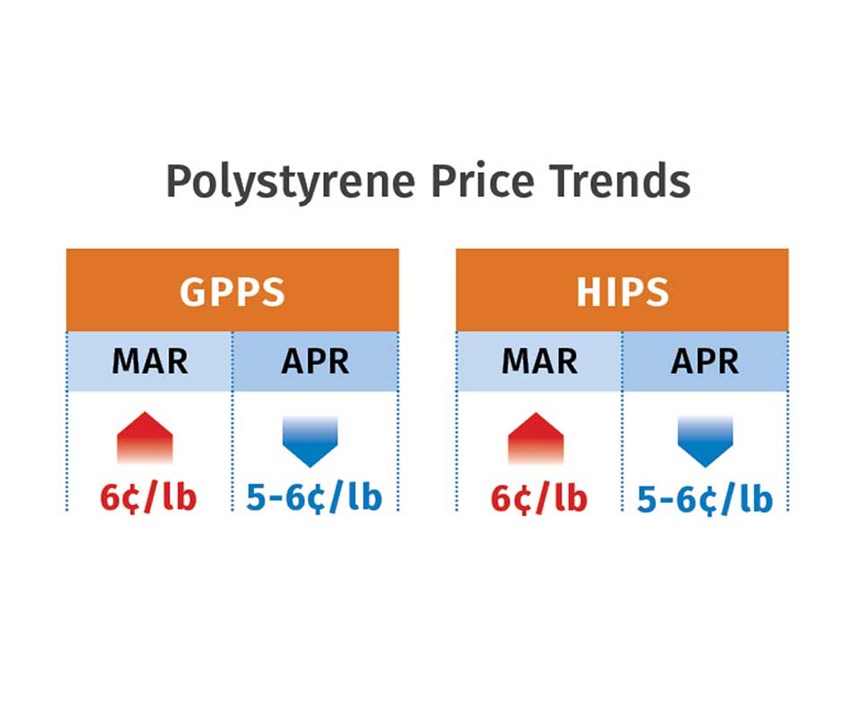

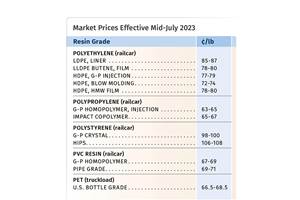

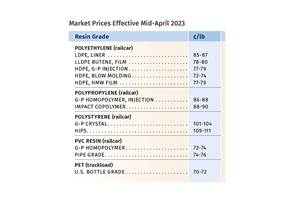

The upward trend of commodity resin prices was reversing itself as we entered the second quarter, despite further price hikes in March for PE, PP, PS, PVC, and PET. Factors driving the reversal include recovery of suppliers’ inventories after planned and unplanned resin and monomer production disruptions, the decline of prices for nearly all key feedstocks, and generally slower export activity due to lower global resin prices.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The in Chicago, and Houston-based PetroChemWire (PCW; petrochemwire.com).

PE PRICES UP FOR NOW

Polyethylene prices moved up 3¢/lb in March as suppliers split their 6¢/lb increase between March and April, with implementation of the latter half now questionable. This brought the total increase of PE prices this year to 8¢/lb. PCW reported in late March that market chatter indicated a tendency among domestic buyers to delay purchases until April in anticipation of lower prices.

Meanwhile, Mike Burns, RTi’s v.p. of client services for PE, ventured that implementation of the April increase would depend largely on the speed of recovery of supplier inventories, which he thought would take place going into this month, if not earlier. The earlier tightness resulted from a combination of heavy domestic and export prebuying in late 2016 and early this year, as well as unplanned outages and scheduled plant turnarounds. If not implemented in April, the increase would not happen this month, either, in Burns’ view.

Reporting on the spot market, The Plastics Exchange’s Greenberg noted, “Demand remained mostly uninspired, with the best buying seen for HDPE injection, still the tightest of commodity PE resins. Spot PE prices have softened even as contract prices rose again in March.”

Burns pointed out that the delta between domestic and global PE prices (the latter have been coming down), should be 7-10¢/lb, but it is currently over 13¢, or 30-40%. He anticipated that activity in the spot and export markets would be the first indicator of any price decline in the second quarter.

PP PRICES TREND DOWNWARD

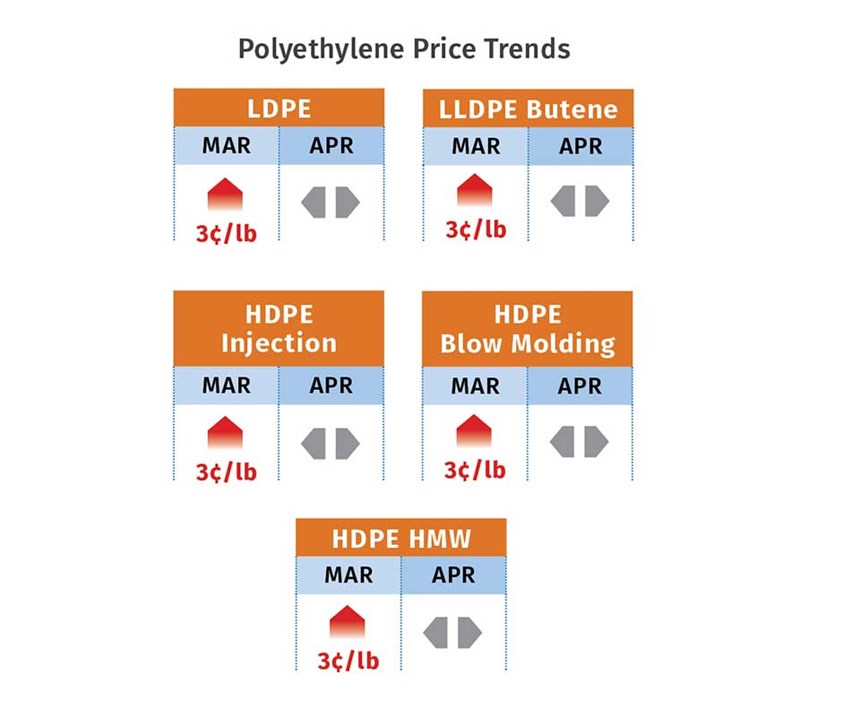

Polypropylene prices moved up 4¢/lb in March, in step with propylene monomer contracts, but it appeared that prices had peaked for both, according to Scott Newell, RTi’s v.p. of PP mar- kets, in agreement with both Greenberg and PCW.

Moreover, with spot monomer prices dropping quickly by 8¢, to 40¢/lb by early April, late-settling monomer contracts were expected to come down at the very least by 2¢, and more likely by as much as 4-6¢, and PP prices would follow by a like amount, according to RTi’s Newell. PCW reported that as spot PP prices edged lower, some PP suppliers were eager to move inventory, and buyers anticipated downward pressure from monomer in the second quarter. Meanwhile, Greenberg reported, “It is important to note that spot PP levels did not rise nearly as much as contracts during this cycle rally. As such, spot PP has developed a steep discount to contracts, so even as spot PP could see some further softness, there might be limited downside, and we expect monomer-tied contracts to fall by a larger magnitude and the spot discount to shrink.”

Similarly, Newell ventured that significant price decreases are likely throughout the second quarter. On the other hand, he expected demand to be good and production rates to be high, and noted that PP resin imports have dropped to nearly 2015 levels following last year’s influx. The market could get tight again in the second half of the year if demand continues to be strong. Newell ventured that suppliers may push again for margin increases.

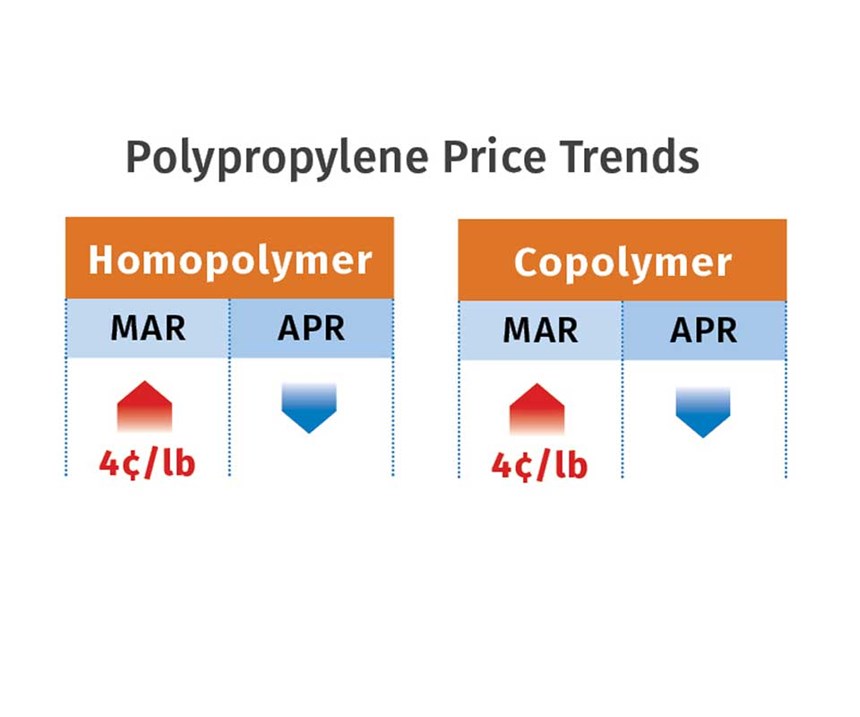

PS PRICES UP, THEN DOWN

Polystyrene prices rose 6¢/lb in March, after moving up a total of 13¢/lb in the previous two months. However, one supplier announced a 5¢/lb decrease for April, and others were expected to follow, according to both PCW and Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Suppliers were able to push through what is expected to be a short-lived increase due to a number of planned and unplanned outages and late restarts, despite much lower feedstock prices. Benzene dropped 30% in March, styrene monomer was down 10¢/lb, and butadiene prices dropped by 17¢/lb. Kallman noted that the 6¢/lb PS price hike exceeded the change in feedstock costs during the first quarter. He expected April PS prices to drop back 6¢, with a good possibility of further downward movement in May, even though the second quarter is the busy season.

“There’s been talk about some demand destruction,” he said referring to the high domestic PS prices. Resin suppliers also have to contend with falling global PS prices.

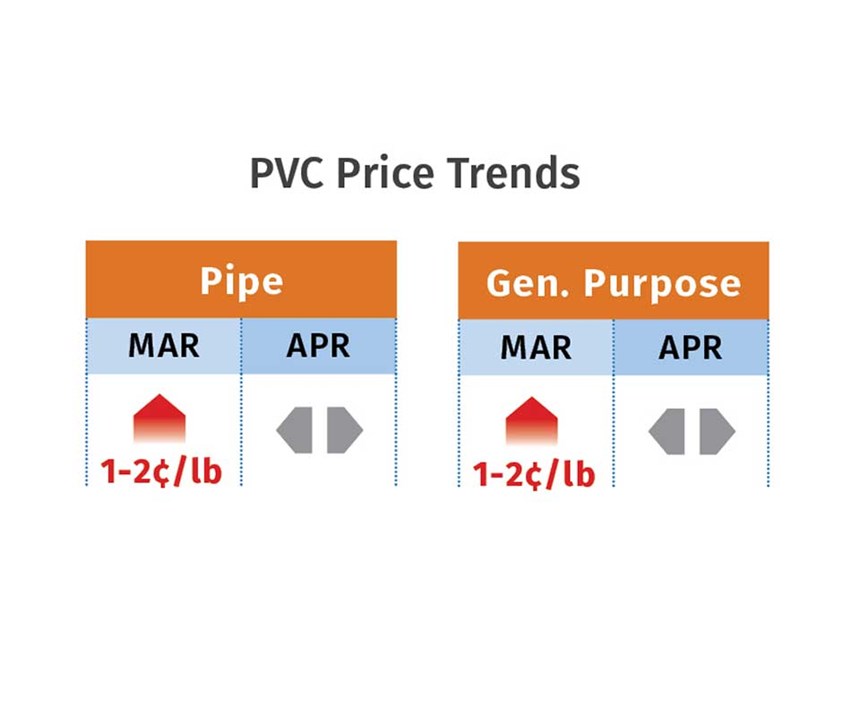

PVC PRICES SET TO RETREAT

PVC prices appear to have moved up by1-2¢ out of the 3¢/lb sought by suppliers in March, while the April 3¢/lb hike was expected to fall by the wayside. RTi’s Kallman ventured that by May, PVC prices would drop 1-3¢.

Not only were resin inventories expected to be in good shape, but PVC exports were down as global prices dropped. Improved operations along the entire supply chain, along with added ethylene capacity from OxyChem and expected lower ethylene prices, are expected to put downward pressure on PVC prices as the construction season gets underway. According to Kallman, “Demand entering the construction season will play a role: If strong, we may see March prices extended for a month before lower pricing can be obtained.”

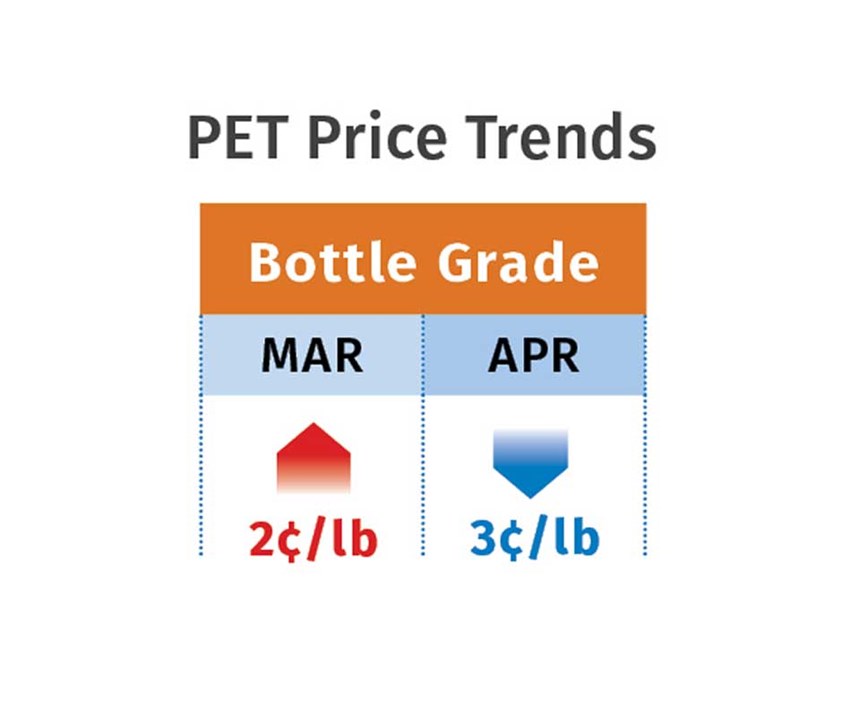

PET PRICES RISE, THEN SLIDE A BIT

Domestic bottle-grade prime PET prices in March averaged 60¢/lb, up 1.7¢/lb from February, based on PCW’s Daily PET Report. That price represents PET business on a delivered Chicago basis. That price on April 7 dropped to 57¢/lb.

Meanwhile, imported prime PET prices were also up in March, averaging 57.6¢/lb, up 4.3¢ from February (on a delivered, duty-paid, U.S. port basis). The price for imported PET on April 7, slid

a bit to 57¢/lb. (Note: The U.S. Dept. of Commerce, as of January 2017, designates imported prime PET as having an IV of 78 ml/g or higher, and deleted the reference to this PET as “packaging grade.”)

Prices rose primarily due to higher costs for feedstocks— including PTA, MEG, and PX—driven by higher hydrocarbon prices and strong demand for intermediates, according to Xavier Cronin, senior editor for this PCW report. However, the average cost of these key feedstocks in March was about 55¢/ lb, 1¢/lb lower than in February.

Related Content

PS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreSustainable Resource Management of Plastic Feedstocks

How Encina sees its future in the circular economy.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More